Trade Reflection: American Battery Technology Company (ABAT)

Trade Summary

Instrument: Long-dated call option

Position: ABAT Dec 19, 2025 $3.00 Calls

Entry: July 21, 2025

Exit: October 15, 2025

Outcome: +606% realized gain

Investment Thesis

The core thesis behind my ABAT position was that battery material supply chains are undergoing a structural transition, and companies offering domestic (US), circular, and environmentally efficient solutions would be re-rated disproportionately as capital markets increasingly internalize energy security and sustainability constraints.

ABAT stood out due to its closed-loop lithium battery recycling model, which directly addresses three critical bottlenecks in the lithium ecosystem:

Supply security – reducing reliance on foreign lithium sources

Environmental impact – materially lower emissions and land disruption versus traditional mining

Cost and scalability optionality – recycling economics improve as EV penetration increases

Unlike early-stage lithium miners, ABAT’s approach is technology-driven rather than asset-heavy, positioning the company closer to an industrial processing and intellectual-property model than a conventional resource extractor. The market had not fully priced this distinction at entry.

Catalyst Framework

At entry, ABAT exhibited the characteristics I look for in a convex, long-dated options opportunity:

Small-to-mid cap equity with high sensitivity to narrative shifts

Alignment with policy tailwinds (in this case, U.S. domestic battery supply, recycling mandates)

Low absolute share price, creating option convexity at relatively modest capital risk

While no single binary catalyst was required, the trade was structured around the idea that incremental positive news flow – regulatory support, partnerships, capacity milestones, or broader lithium sentiment – could drive a rapid repricing.

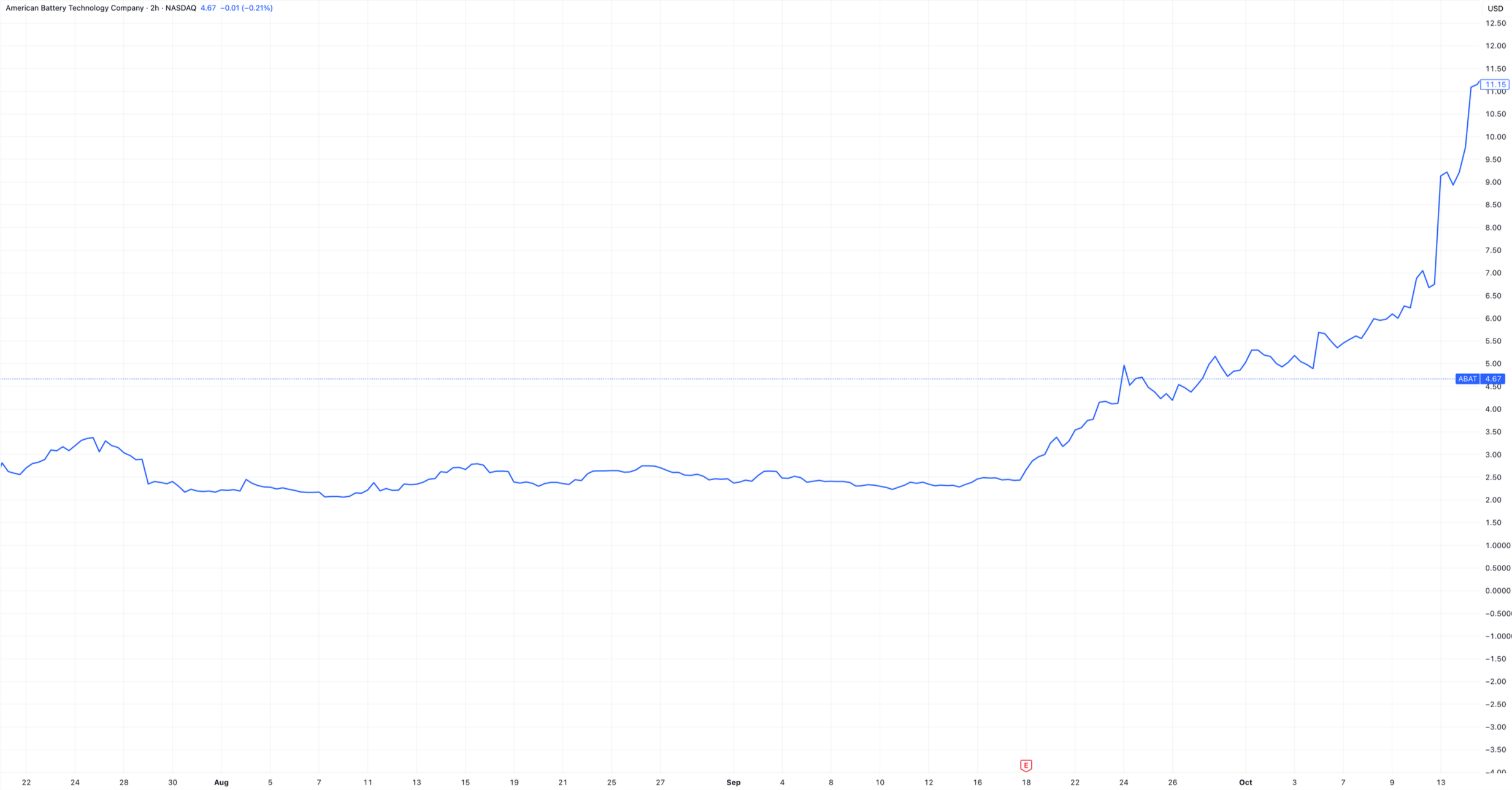

This proved correct. Over the following months, ABAT experienced a sharp upward repricing, driven primarily by momentum, narrative reinforcement, and expanding risk appetite toward lithium-linked equities.

ABAT Stock Movement During Trade (July 21, 2025 - October 15, 2025)

Trade Construction and Risk Management

I expressed the view through Dec 19 2025 $3.00 calls, which provided:

Sufficient duration to avoid timing risk

High delta sensitivity once the stock moved through key levels

Defined downside via premium paid

The position size was calibrated such that:

A total loss of premium would not impair portfolio-level performance

Upside convexity was meaningful if the thesis played out

This was a non-linear payoff structure designed to monetize narrative acceleration rather than long-term cash flow realization.

Exit Rationale

By mid-October 2025, ABAT had appreciated sharply, and the character of price action changed materially.

Key exit considerations:

Valuation disconnected from near-term fundamentals

Price action increasingly driven by momentum rather than information

Elevated volatility consistent with late-stage speculative behavior

Diminishing marginal upside relative to downside risk

While the long-term thesis around battery recycling remained intact, the risk-reward profile of the option no longer did.

Critically, the market had begun to price multi-year execution success into a company still early in its commercialization curve. At that point, the trade had transitioned from a convex thesis-driven opportunity into a momentum-dependent bet.

I exited the position on October 15, 2025, locking in a 606% gain.

Outcome and Attribution

Return: +606%

Primary drivers:

Narrative repricing

Option convexity

Volatility expansion

The return was not dependent on a single announcement or earnings event, but rather on the market’s rapid reassessment of the company’s strategic relevance.

Post-Trade Reflection

This trade reinforced several principles that are central to my investment process:

Narrative inflection and convex instruments can generate outsized returns even absent of near-term earnings power

Long-dated options are most effective when the path of repricing matters more than terminal value

Exiting when upside becomes speculative, rather than squeezing the final percentage points, is critical to long-term capital preservation

While ABAT may continue to execute operationally over time, the decision to exit was driven by discipline, not a rejection of the underlying technology.

Conclusion

The ABAT trade exemplifies how thematic research, structural tailwinds, and disciplined derivatives usage can translate into asymmetric outcomes. The key was not predicting long-term dominance, but recognizing when market perception could change faster than fundamentals and exiting once that repricing appeared fully expressed.